海外研报

筛选

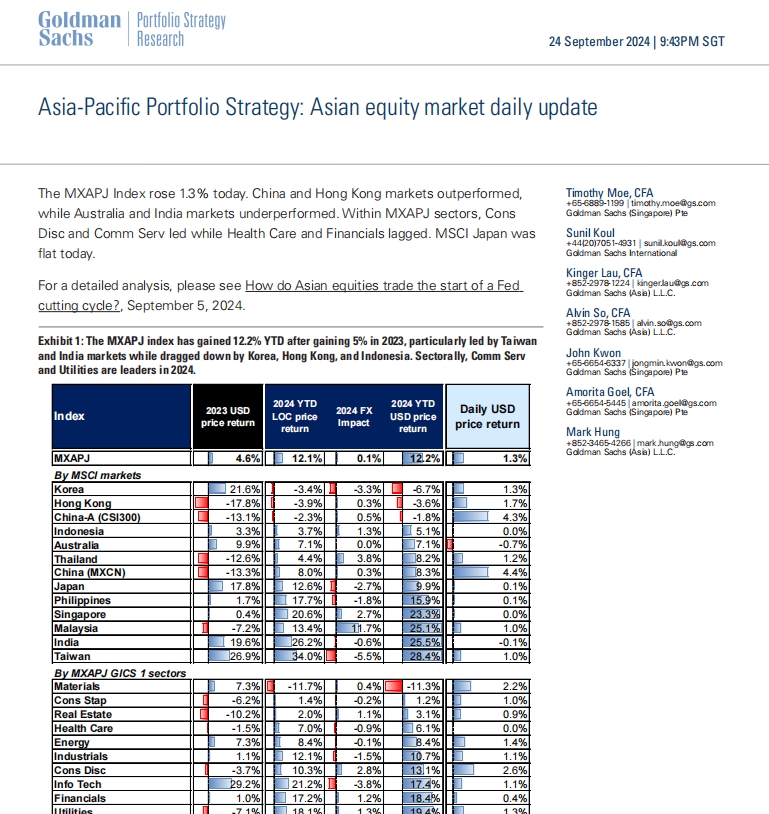

GS--Asia-Pacific Portfolio Strategy: Asian equity market daily update01

The MXAPJ Index rose 1.3% today. China and Hong Kong markets outperformed,while Australia and India markets underperformed. Within MXAPJ sectors, Cons

海外研报

2024年09月25日

GS--China Consumer Staples: Key investor feedback from European marketing trip

past weeks discussing China consumer staples subsectors and key stock ideas. Ona high level, investor feedback indicated 1) their positions in China consumer

海外研报

2024年09月25日

China optimism exaggerated

Topic of the week: Upward revision to our gold price forecastImportant news of the last few days: Escalation in the Middle East conflict pushes up

海外研报

2024年09月25日

GS China Economics Outlook_ September 2024 [Presentation]

Current state of the economy:

海外研报

2024年09月25日

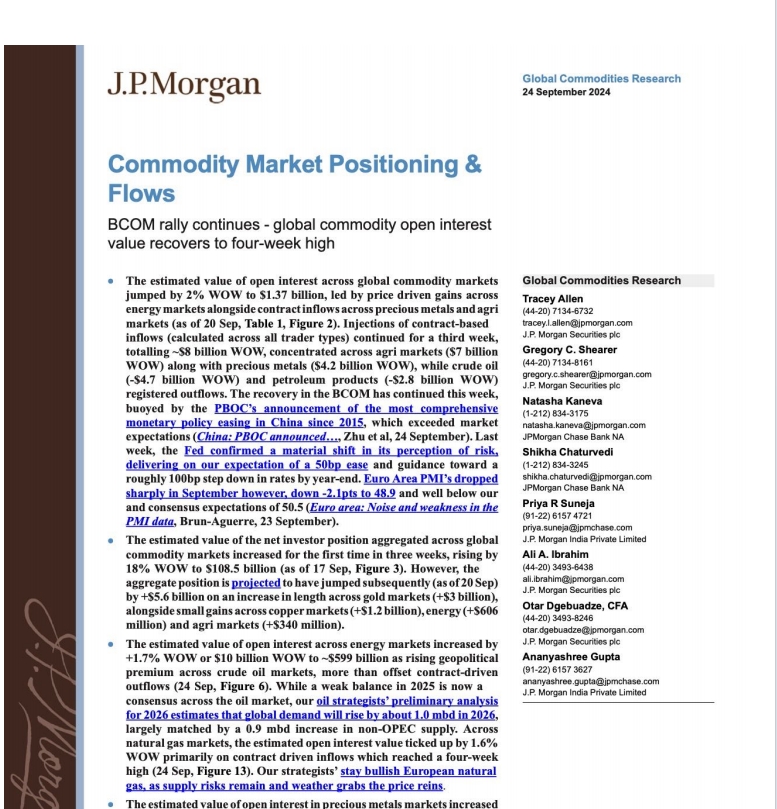

JPM_Commodity Market Positiong & Flows_20240924

The estimated value of open interest across global commodity marketsjumped by 2% WOW to $1.37 billion, led by price driven gains acrossenergymarkets alongsidecontractinflows across precious metals and agrimarkets (as of 20 Sep, Table 1,

海外研报

2024年09月25日

MS_Charts That Caught My Eye_20240924

A guiding principle at Morgan Stanley Research is to enhance your investment process by delivering unique insights that

海外研报

2024年09月25日

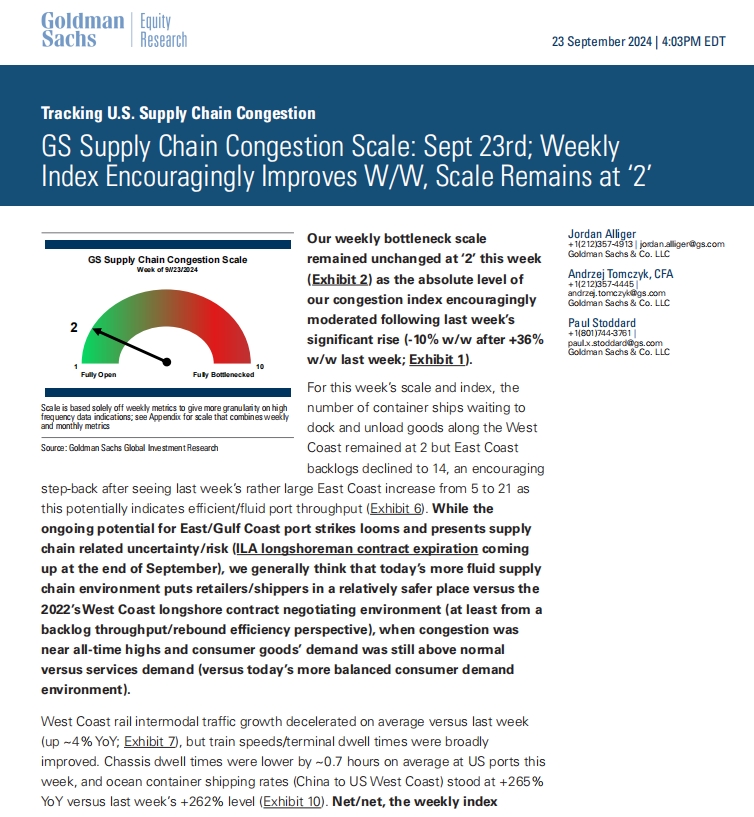

GS-- Sept 23rd; Weekly Index Encouragingly Improves W/W,

step-back after seeing last week’s rather large East Coast increase from 5 to 21 asthis potentially indicates efficient/fluid port throughput (Exhibit 6). While the

海外研报

2024年09月25日

Global Strategy Weekly

I must apologise for falling asleep on the job. I hadn’t spotted that the US personalsaving ratio (SR) had slid all the way back to what I would describe as crisis levels.

海外研报

2024年09月27日

GS--Asia Views: The Fed opens the door, and the PBOC walks through

1. The People’s Bank of China announced a combination of monetary easingsteps this week. These included: a 20bp repo rate cut and a 50bp RRR cut (double

海外研报

2024年09月27日