海外研报

筛选

Nomura Quant Insights

Best to keep an eye on macro hedge funds' continued bullishness on US equitiesIn the US, the S&P 500 continued its slide yesterday. It looks as though in the run-up to

海外研报

2024年09月10日

RBC_Gold Assayer Riding the High – September 2024 Issue

Gold prices are highly data dependent on a daily basis, and at the same time also riding the high of a confluence of supportive narratives. Rate

海外研报

2024年09月10日

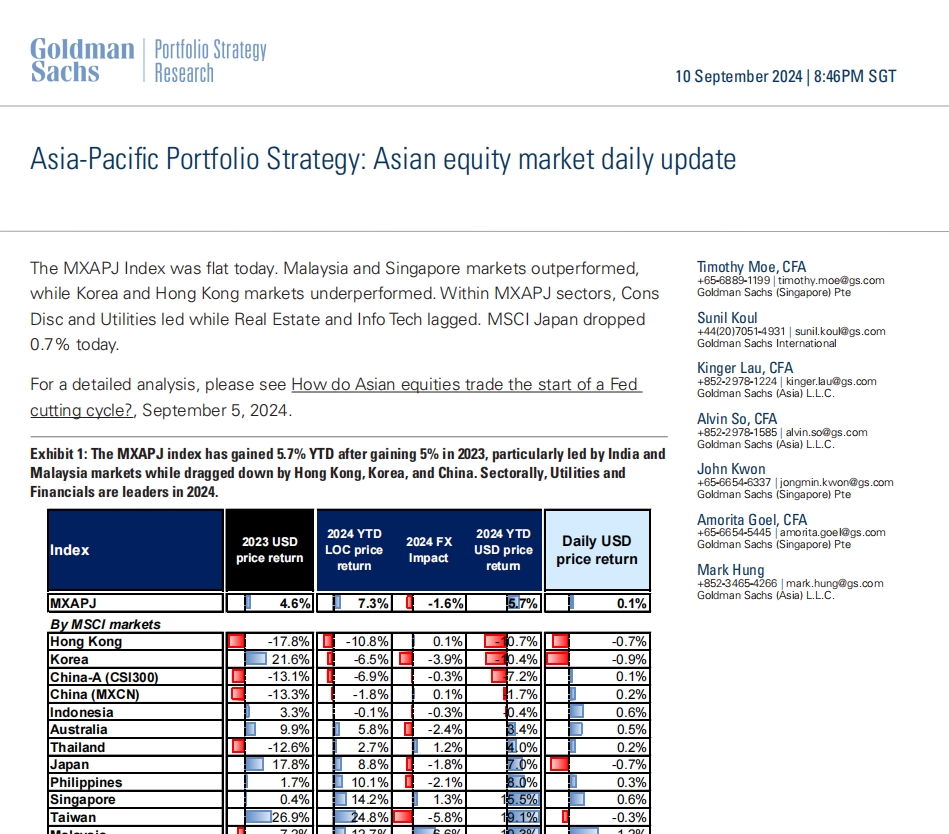

GS--Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Malaysia and Singapore markets outperformed,while Korea and Hong Kong markets underperformed. Within MXAPJ sectors, Cons

海外研报

2024年09月11日

GS--AT&T Inc. (T): Communacopia + Technology Conference 2024 — Key Takeaways

Bottom line: We have three key takeaways: (1) Management continues to expect anormalization in the wireless industry, but has not seen this occur. The company

海外研报

2024年09月11日

GS--Positioned for a prolonged cycle

In 2Q24, we saw topline weakness/misses due to a prolonged slowdown and risingdownside risks in macro and persistent deflationary pressure as well as companies’

海外研报

2024年09月11日

JPM_Credit Calls Tuesday, September 10

Strategy & Sector CommentaryHG Credit Foreign Demand Monitor: Lower hedging costs are propellingAPAC overnight b

海外研报

2024年09月11日

EF--Mixed jobs report offers no definitive signal for the Fed

The August employment report was a decidedly mixed one, improving compared to July but by less than anticipated for some metrics. On

海外研报

2024年09月11日

MS - How Much Would a 28% Corporate Tax Rate Lower EPS

We assess the EPS impact of a potential proposal to increase the corporate tax rate 7ppt from 21% to 28%, with a median

海外研报

2024年09月11日

GS--Oil Tracker: Record Low Financial Demand vs. Resilient Physical Demand

The Brent crude price continued sliding down over the last week to the lowest levelsince December 2021, with the disappointing US jobs report on Friday pushing Brent

海外研报

2024年09月11日