海外研报

筛选

Barclays_What's Next in AI – The Semi Perspective_20240919

We recently published a note in coordination with Barclay'sInternet team, "What’s Next in AI?". Below we highlight the

海外研报

2024年09月20日

GS--BoE Holds Policy Rate at 5.00% on 8-1 Vote; Notes “Gradual Approach” Remains Appropriate

BOTTOM LINE: The BoE voted by a majority of 8-1 to keep Bank Rate unchanged at5.00% at the September MPC meeting, with Dhingra dissenting in favour of a 25bp

海外研报

2024年09月20日

BofA - Savita Subramanian - Equity Strategy Focus Point_20240919

Old-school capex cycle in the worksA confluence of factors argue for an old school capex cycle: trade and tech wars, COVID,

海外研报

2024年09月20日

BofA_US Watch September FOMC meeting- A hawkish 50_20240918

A hawkish 50The Fed attempted to sell its 50bp rate cut today as a “recalibration” of policy rates,

海外研报

2024年09月20日

CB Views_ September 2024 FOMC Recap

The FOMC kicked off the start of its easing cycle with a 50bp cut, bringing the Fed Funds target range to 4.75-5.00%. The jumbo cut was

海外研报

2024年09月20日

China_ the playbook for a steeper CNH rates curve

less attraction for basis-driven cross-border flows, but not a reversal.Foreign flows to onshore NCDs had already slowed in August, and are

海外研报

2024年09月20日

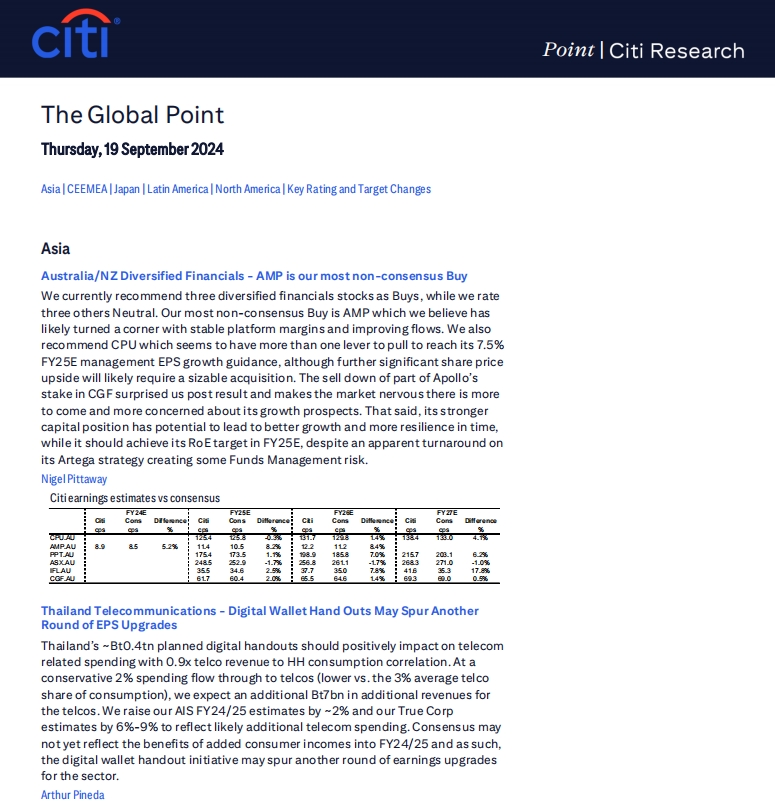

Citi_The Global Point Thursday, 19 September 2024

Australia/NZ Diversified Financials - AMP is our most non-consensus BuyWe currently recommend three diversified financials stocks as Buys, while we rate

海外研报

2024年09月20日

Commodities Weekly--All systems go in the commodities complex as the Fed begins its easing cycle

Global commodities: Commodities are relishing. In the last seven trading days lead-up to yesterday’s FOMC meeting, the Bloomberg Commodities (BCOM) index

海外研报

2024年09月20日

DeskTalk - FOMC risk rally at big levels

DXY Index is once again major support at 100.42-100.79 (200w MA, December 2023 low, Feb & March 2023 lows)while our trader's watching 1.1200-55 in EURUSD. We wait for the weekly close, Global FX Strategy argues Fed rate

海外研报

2024年09月20日

GS-- Global RT volumes remain +ve through August, helped by steady developments in Europe

Europe growth supports global PC/LT RT volumes to +2% in August, offsetpartially by China and NA declines - Michelin released its latest market data for

海外研报

2024年09月20日