海外研报

筛选

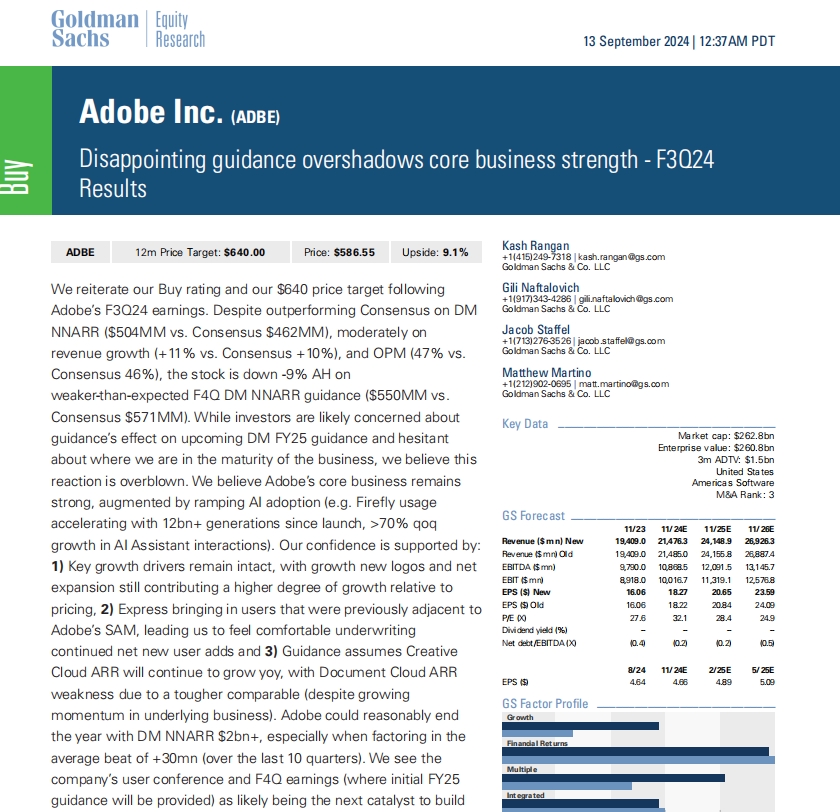

GS--Disappointing guidance overshadows core business strength - F3Q24 Results

We reiterate our Buy rating and our $640 price target followingAdobe’s F3Q24 earnings. Despite outperforming Consensus on DM

海外研报

2024年09月15日

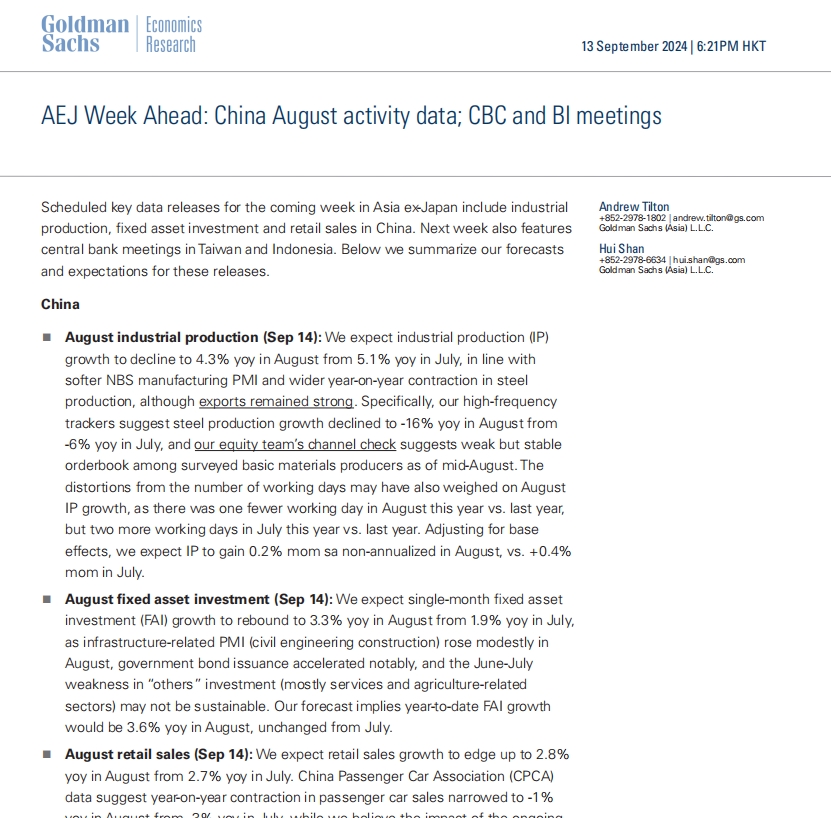

GS--AEJ Week Ahead: China August activity data; CBC and BI meetings

growth to decline to 4.3% yoy in August from 5.1% yoy in July, in line withsofter NBS manufacturing PMI and wider year-on-year contraction in steel

海外研报

2024年09月15日

GS--What’s Powering Your Services Recap - 9/13/24

This week in Business & Information Services, we had a number of companiespresent at our 2024 Communacopia + Technology Conference in San Francisco,

海外研报

2024年09月15日

GS--Americas Construction: Building Products: AHRI — July Read-Throughs

decline in June and +9% a year ago. Commercial rose 10% yoy vs down 4% lastmonth and off -7% a year ago. Relative to July 2019, residential shipments grew

海外研报

2024年09月15日

Asia--Macro_Weekly_Asia_local_markets_resilience_to_be_tested

The Fed is widely expected to begin its monetary easing next week. Amid divided views on the size and pace of US monetary easing, we expect three

海外研报

2024年09月15日

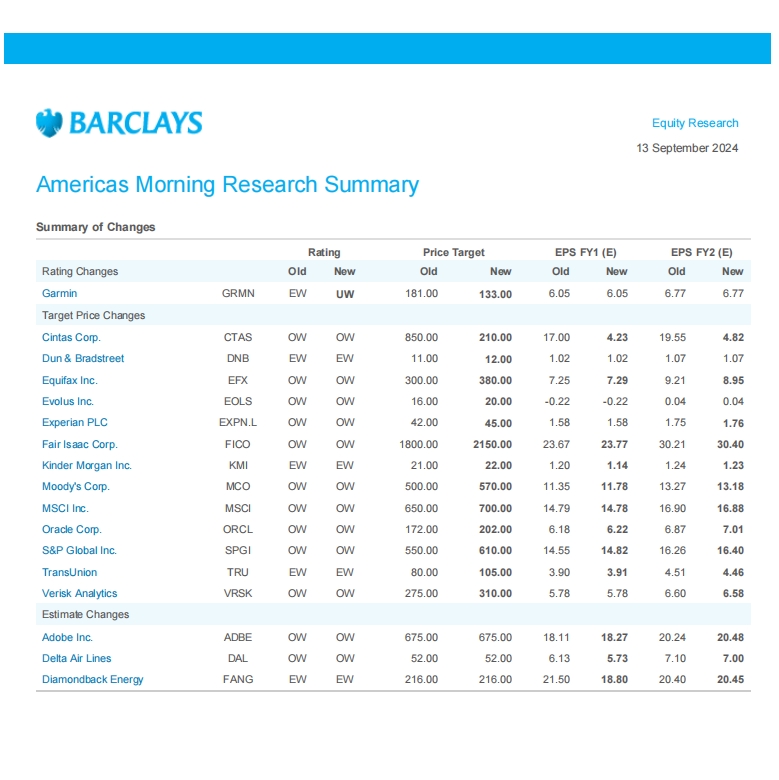

Barclays--Americas Morning Research Summary_20240913

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年09月15日

Barclays--European Morning Research Summary_20240913

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年09月15日

BofA - Hartnett - The Flow Show 3B Bulls_20240912

Scores on the Doors: gold 21.6%, stocks 13.6%, crypto 9.1%, HY bonds 6.9%, IG bonds 4.8%, cash 3.7%, govt bonds 2.2%, US dollar 0.3%, commodities -2.0%, oil -6.1% YTD.

海外研报

2024年09月15日

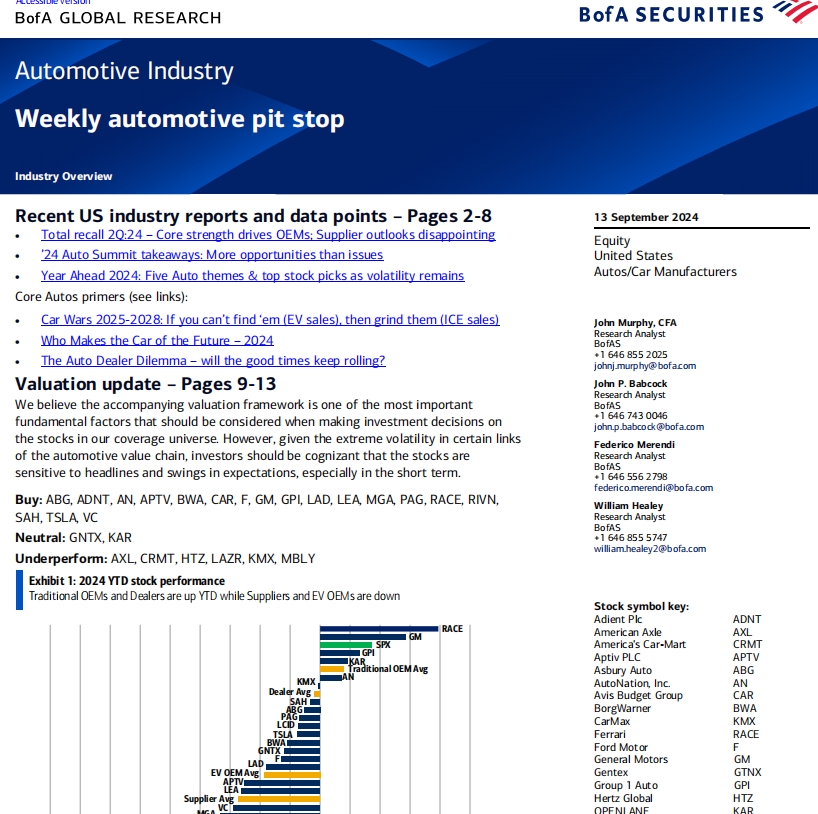

BofA--Automotive Industry Weekly automotive pit stop_20240913

Recent US industry reports and data points – Pages 2-8 • Total recall 2Q:24 – Core strength drives OEMs; Supplier outlooks disappointing•

海外研报

2024年09月15日

BofA_Macro Risk Digest So it begins_20240913

We estimate corporates in Europe and Asia collectively held around $1trn of FX deposits in 1Q 2024. An unwind could amplify USD depreciation, although more likely over the

海外研报

2024年09月15日