海外研报

筛选

China Musings The good and the bad of being different

MSCI China has lost 6% in the past 1 month as equity volatility surged acrosskey markets, extending its correction from the highs in mid-May to 12% and is

海外研报

2024年08月15日

Interest Rates Daily-Energy awakening?

Oil and gas market prices are both strongly up in the last few weeks, albeit for different reasons.

海外研报

2024年08月15日

First Look: A Reassuring Beat in Q2 24

Nubank posted net income that was 12.7% above consensus, a reassuringbeat following all the prevailing noise on rising NPLs and slowing loan growth

海外研报

2024年08月15日

Global Markets Daily: Credit Fund Flows: A Look Back and Forward (Shumway)

Three themes emerged from the trajectory of fixed income fund flows throughthe Fed’s recent hiking cycle. The first is a preference for quality, driven by

海外研报

2024年08月15日

MercadoLibre (MELI US)-Buy: More levers to pull; raise TP

◆ Gaining share with GMV (FX-neutral) growth of 83% y-o-y; commerce take rate expands 120bp y-o-y

海外研报

2024年08月15日

BOJ watch: Bank suspends further rate hikes after being blamed for dramatic moves in yen and stocks

Global financial markets experienced major turmoil in the first part of August. On the fifthof the month the Nikkei 225 posted a larger drop than it did on Black Monday in 1987, and

海外研报

2024年08月15日

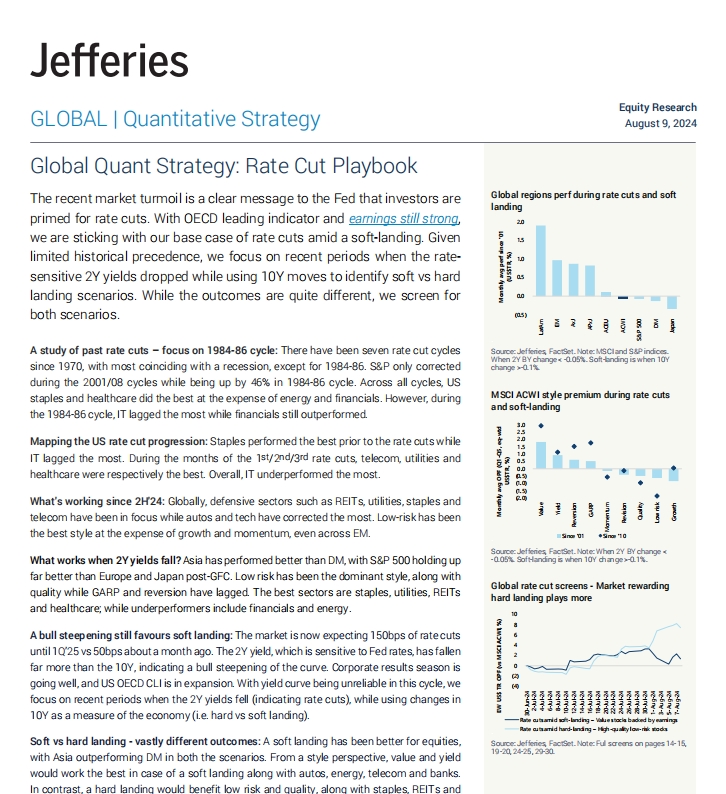

GLOBAL | Quantitative Strategy-Global Quant Strategy: Rate Cut Playbook

The recent market turmoil is a clear message to the Fed that investors areprimed for rate cuts. With OECD leading indicator and earnings still strong,

海外研报

2024年08月15日

Argentina Equity Strategy

Almost a year ago, we published the note Back to the Future? Similarities and Differences vs. 2015 Election, analyzing how Argentine equities behaved ahead of

海外研报

2024年08月15日

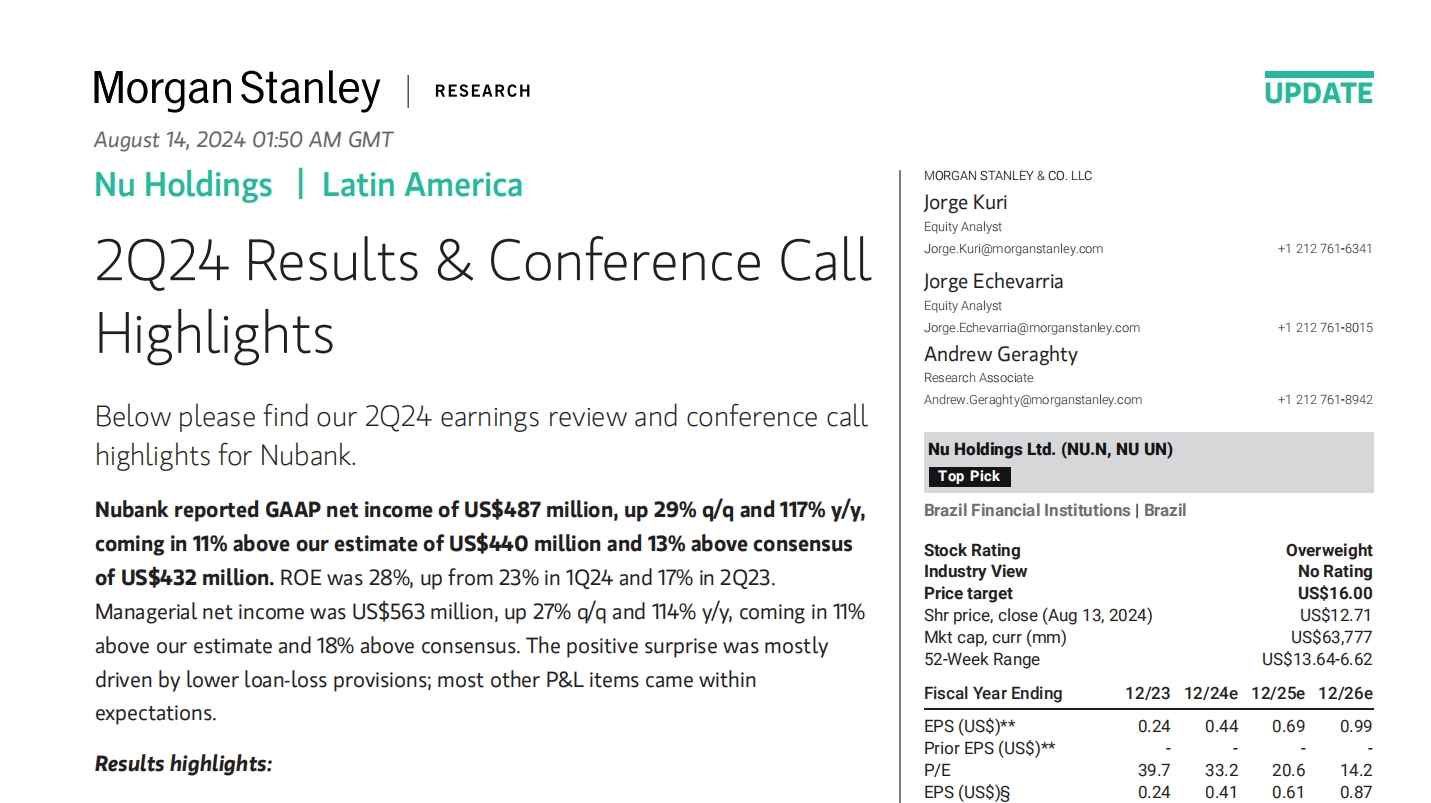

2Q24 Results & Conference Call Highlights

Nubank reported GAAP net income of US$487 million, up 29% q/q and 117% y/y, coming in 11% above our estimate of US$440 million and 13% above consensus

海外研报

2024年08月15日

Nomura Quant Insights

US equity rebound being powered by macro hedge funds buying the dipUS equities (S&P 500) have continued to pick themselves back up. Investors have gone

海外研报

2024年08月15日