海外研报

筛选

Europe Weekly Kickstart Deep summertime blues

Global equities stand 6% below their mid-July peak.Most equity markets saw a correction, triggered by weaker

海外研报

2024年08月12日

DM Sovereign Supply Outlook

This week, the US Treasury will auction a new 3Y T.Note.10Y T.Note and 30Y T.Bond

海外研报

2024年08月12日

European and US Credit:Weekly ChartpackAn overview of credit markets

Credit spreads widened notably towards the end of last week in the wake of weaker thanexpected US labour market numbers, a theme that we previously highlighted in our H2outlook (H2 outlook- borowed time, 4 June 2024). Our base case

海外研报

2024年08月12日

GEMs Equity Wrap-up July 2024

In July 2024, EM equities underperformed all other major regional indices, though allwere in positive territory, india contributed most positively, distantly followed by SouthAfrica, but it was majory offset by the negative performance of Taiwan

海外研报

2024年08月12日

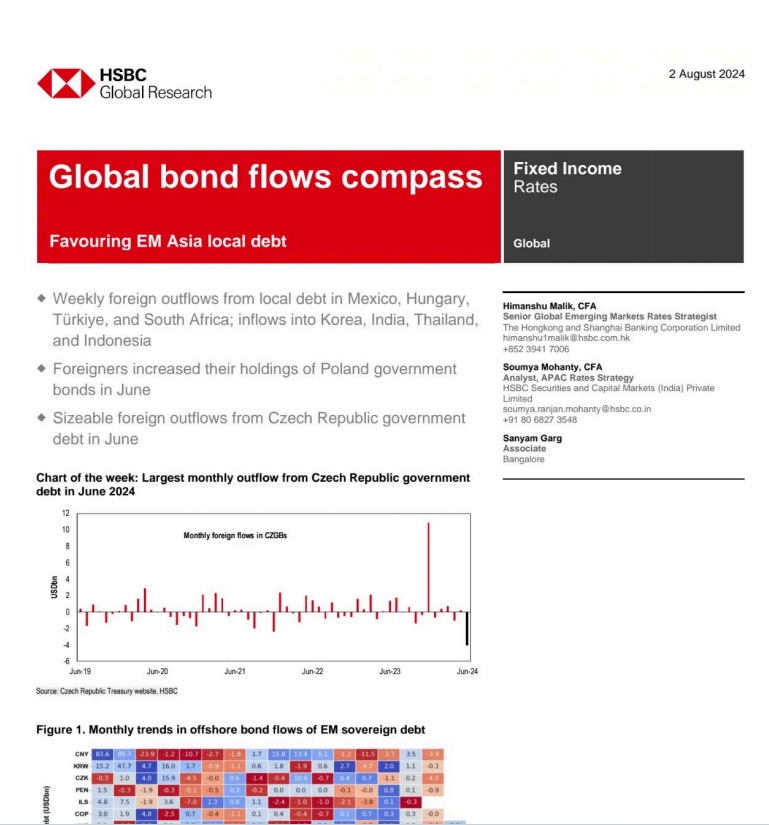

Global bond flows compass

Weekly foreign outflows from local debt in Mexico, HungaryT¼rkiye, and South Africa; inflows into Korea, India, Thailan?and

海外研报

2024年08月12日

Investor Allocations

Marginal decline in price momentum; fund inflows remain strongAmid a somewhat a dovish tone in the July FOMC meeting, which laid thegroundwork for possible rate cuts in September and beyond, globalequities (FTSE All World) ended the month

海外研报

2024年08月12日

Flows & Liquidity Where have we seen most unwinding?

Momentum-driven investors such as CTAs saw a sharp unwind of long equity positions, short yen and short 10y Bund and JGB positions, while

海外研报

2024年08月12日

Global Data Watch

Recent discussion in these pages has focused on the shifting risk bias around our global narrative of sustained growth resilience, sticky inflation, and shallow

海外研报

2024年08月12日

US Weekly Prospects

Compared to last week’s event-filled calendar, the relatively quiet schedule this week gave time to pause and reflect on the

海外研报

2024年08月12日

The Weekly Worldview: The cycles advance

Last week was marked by three key central bank decisions. The BoJ hiked for the first time after ending negative interest rate policy (and specified a plan to reduce

海外研报

2024年08月12日