海外研报

筛选

Supply and Cash Flow Monitors

EUR22.5bn gross supply and EUR0.9bn net supply on the back of bigBTP redemptions and Bunds coupons. On offer new 10Y Bund, Green Bunds tap, LT OAT, SPGB (new 7Y) /

海外研报

2024年07月01日

US Macro Weekly--Jobs report in the spotlight

Week ahead A busy week will be highlighted by the June employment report, releasedfollowing a mid-week break for the July 4th holiday. Also on deck areboth ISMs, JOLTS job openings, and the minutes from the June FOMC,

海外研报

2024年07月01日

The W&W Indicator falls to marginally bullish in Jun

Indicator falls to the “marginally bullish” zone in JunThe monthly and weekly average of BofA China A-share Wax & Wane Indicator in Jun

海外研报

2024年07月04日

Seeking Certainty Amid Change

We expect a range-bound market in near term, as recent rallyhas largely priced in the positive developments since February.Despite positive policy pivots, we caution against persistentdeflation pressure and rising complexity from trade protection

海外研报

2024年07月01日

GS--Asia-Pacific Portfolio Strategy: Asian equity market daily update06

The MXAPJ Index rose 2.0% today. China and Korea markets outperformed, while

海外研报

2024年09月28日

Yen Carry And AI Bubble: One And The Same Trade

The analysis of price complexity strongly suggests that the ‘yen carry trade’ and the AI bubble are one and the same trade, premised on three conditions:

海外研报

2024年08月15日

MS-- Global Macro Commentary

ECB cuts by 25bp; sell-off in European duration; USTs marginally cheapen; BoJ's Tamura says BoJ policy rate should be at least

海外研报

2024年09月16日

Cross-Asset Weekly

The financial market turbulences this week have highlighted that (1) macro risks are shifting from inflation to growth, (2) carry trades are vulnerable to sharp reversals in late cycle ear.

海外研报

2024年08月12日

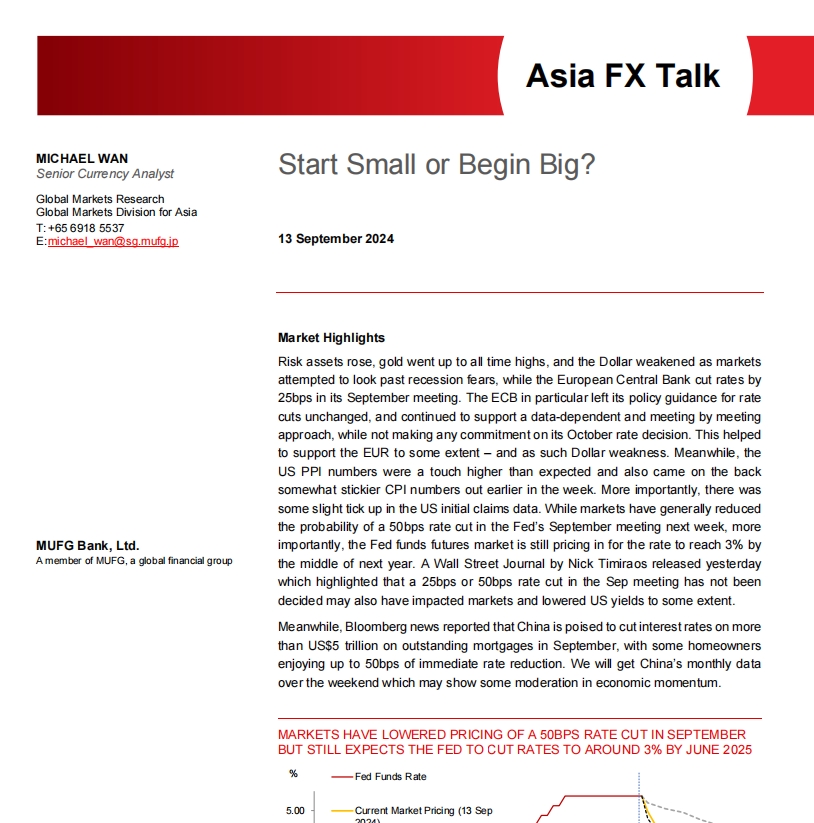

Start Small or Begin Big?

attempted to look past recession fears, while the European Central Bank cut rates by25bps in its September meeting. The ECB in particular left its policy guidance for rate

海外研报

2024年09月15日

FOM--to_cut_by_25bp_and_by_200bp_over_the_cycle_1

We expect the Federal Open Market Committee (FOMC) to start its easing cycle with a 25bp cut at its policy meeting next week. All up we expect

海外研报

2024年09月15日