海外研报

筛选

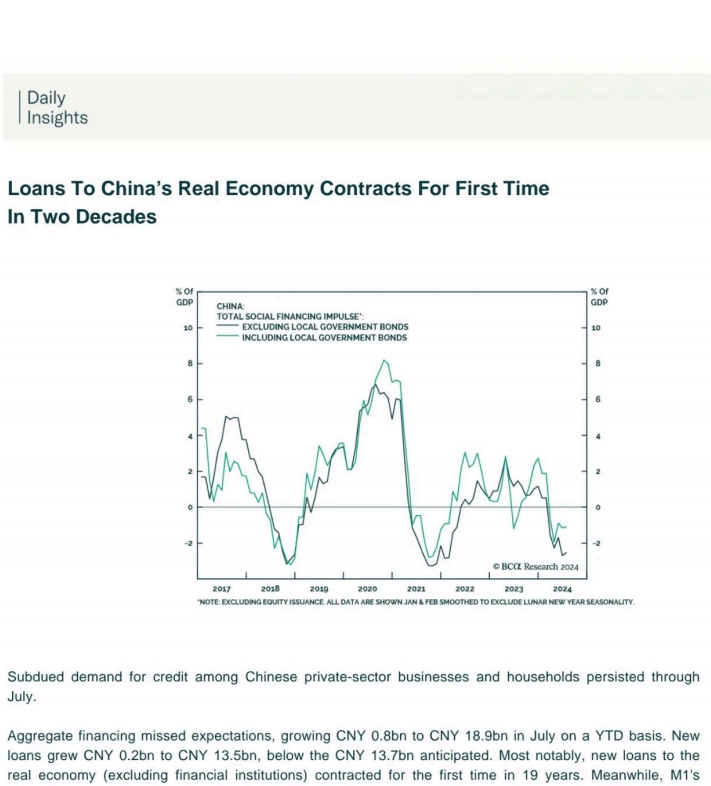

Loans To China's Real Economy Contracts For First TimeIn Two Decades

Aggregate financing missed expectations, growing CNY 0.8bn to CNY 18.9bn in July on a YTD basis. Newloans grew CNY

海外研报

2024年08月15日

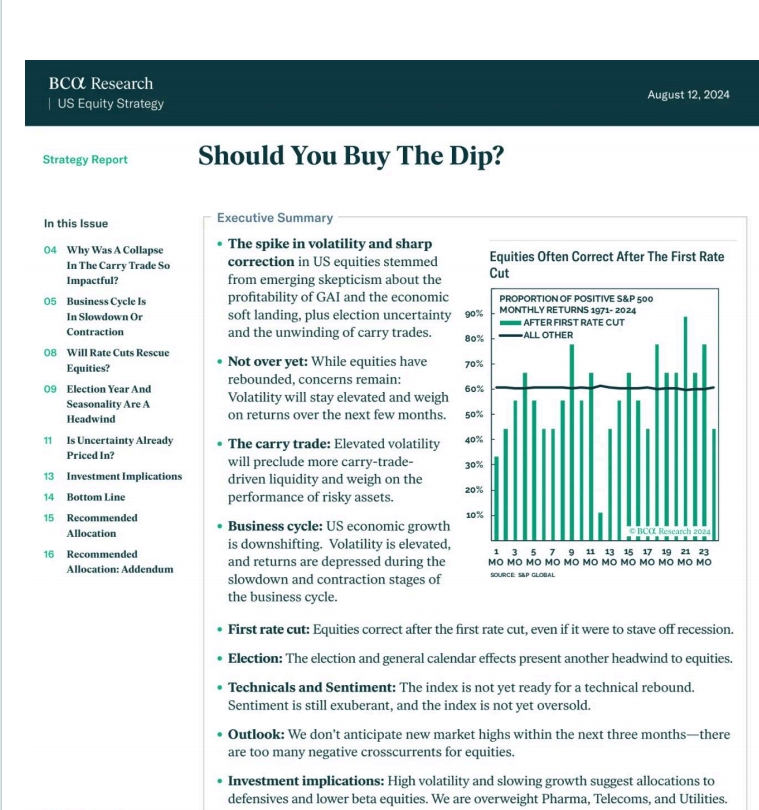

Should You Buy The Dip?

e First rate cut: Equities correct after the first rate cut, even if it were to stave off recession.

海外研报

2024年08月15日

BofA on USA Payback, not a slowdown

We expect a consensus-like retail sales report for JulyTotal card spending per household (HH), as measured by BAC aggregated credit and

海外研报

2024年08月15日

Mixed 2Q24 results: lower crop yields, but higher rice prices and buybacks

2024 yields revised down as harvesting advancesAdecoagro reported 2Q24 results. Although we believe quarterly earnings for

海外研报

2024年08月15日

BofA Securities Equity Client Flow Trends Buying the dip

• Big inflows week: Last week, during which the S&P 500 was essentially flat, BofA Securities clients were net buyers of US equities (+$5.8B) for the first time in five

海外研报

2024年08月15日

Buyer's markets-Global Daily

US producer price inflation was soft in July. Both headline (0.1% m/m and 2.2% y/y) and core (0.0% m/m and 2.4% y/y) PPI inflation came in below expectations. Goods prices rose by 0.6%

海外研报

2024年08月15日

Latest Thoughts Ahead of Kazatomprom (KAP) Production Guidance

In this note, we update estimates for Cameco Corporation (CCJ, Buy) following2Q24 results. While the quarter came in below GS and Street estimates, we note

海外研报

2024年08月15日

China Musings The good and the bad of being different

MSCI China has lost 6% in the past 1 month as equity volatility surged acrosskey markets, extending its correction from the highs in mid-May to 12% and is

海外研报

2024年08月15日

Interest Rates Daily-Energy awakening?

Oil and gas market prices are both strongly up in the last few weeks, albeit for different reasons.

海外研报

2024年08月15日

First Look: A Reassuring Beat in Q2 24

Nubank posted net income that was 12.7% above consensus, a reassuringbeat following all the prevailing noise on rising NPLs and slowing loan growth

海外研报

2024年08月15日