海外研报

筛选

UBS House View Monthly Extended August 2024 - intra-month update

The original report, published on 18 July 2024, is being republished to remove our Asset Class downside scenarios, as

海外研报

2024年08月14日

Oil Tracker: Positioning: Only Up From Here

The Brent crude price rebounded by 6% from a week ago as broader macro marketscontinued to recover, as solid US activity data shifted energy investors’ focus from

海外研报

2024年08月14日

poast Hoc Ergo Propter Hoc

Stocks struggled for direction yesterday as markets looked ahead to a packed data calendar for the rest of the week. The S&P500 closed flat, the NASDAQ rose 0.21% and the EuroStoxx 50

海外研报

2024年08月14日

Multi-Asset Strategy Daily

The first hurdle for UK markets – the labour market report – came in this morning. Wage data were in line, with weekly earnings excl. bonus rising 5.4% on a 3M/YoY basis. This seems like good news, as wages are

海外研报

2024年08月14日

The Risk Of An Inflation Surprise

Investors are so certain that the Federal Reserve is all set to make aggressive cuts in interest rates, that if July’s CPI release this Wednesday comes in higher

海外研报

2024年08月14日

The Ghosts of August Shall Fade August 2024

The last several weeks have been turbulent for equity markets, and the potential for episodic volatility persists amid concerns such as: the Federal Reserve (Fed)

海外研报

2024年08月14日

Viewpoint by Charts

The first half of 2024 brought plenty of potential headwinds for investors, yet resilient consumer spending, better-than-expected corporate profits, and investors’ unchecked enthusiasm for a handful of technology companies more than overcame those

海外研报

2024年08月14日

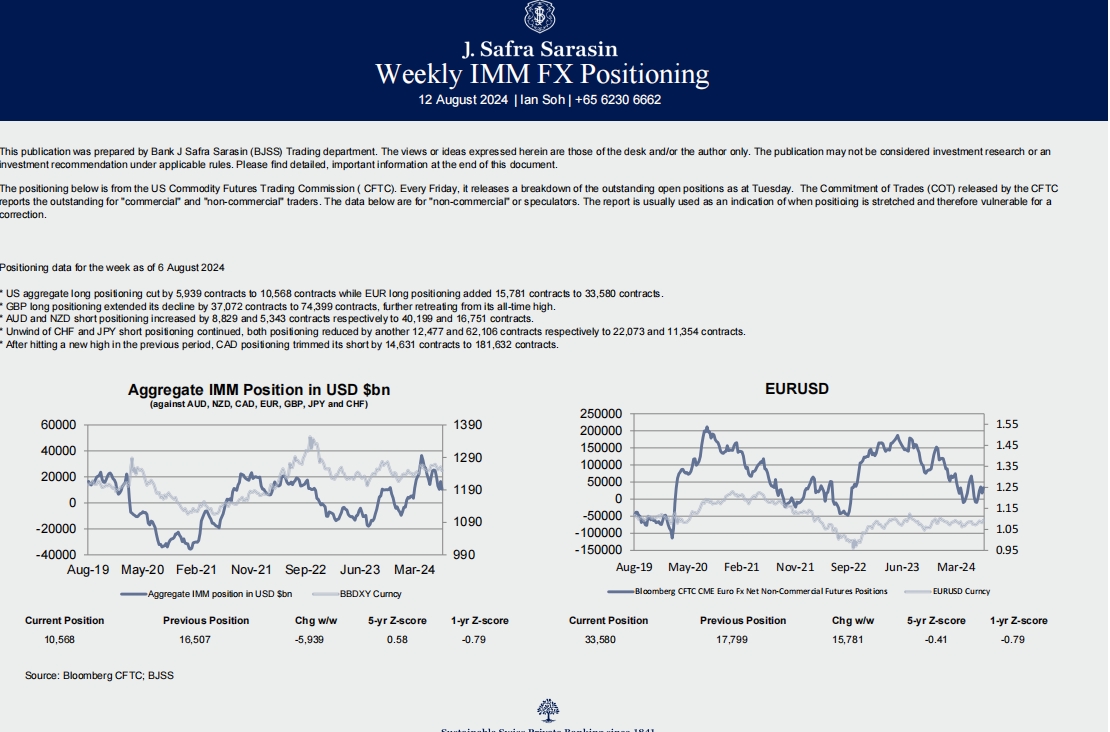

Weekly IMM FX Positioning

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication may not be considered investment research or an

海外研报

2024年08月14日

Weekly commentary

• Recent extreme market volatility shows the impact of sudden sentiment shifts

海外研报

2024年08月14日