海外研报

筛选

Economics Focus:Summer revision course

This summer, we propose a series of short papers on some key macro topics to help you revise your fundamentals so you can be perfectly

海外研报

2024年08月10日

TAIEX -1% despite a 3% rebound in TSMC, amid declines across non-defensive

Performance: MSCI/All Taiwan +0.6%/-0.9% this week,outperforming MXAPJ by +1.5% (in US$), with gains in

海外研报

2024年08月10日

US Economic Perspectives CPI preview comment

We continue to expect a 25 bp rate cut in September and not 50 bp. We view the current debate amongst the FOMC as whether they want to move from long signaling a

海外研报

2024年08月10日

UK—July Inflation and June Labour Market Preview

BOTTOM LINE: We expect the upcoming July inflation print (scheduled for releaseon 14th August) to see services inflation decelerate to 5.48%, down from 5.74% in

海外研报

2024年08月10日

Ukraine: Inflation Rises Above Mid-Point of Target, As Expected

Bottom Line: Headline CPI rose by 0.6pp to +5.4%yoy in July, broadly in line withour forecast and consensus expectations (both +5.3%yoy). This marks the first time

海外研报

2024年08月10日

MONETARY POLICY MATTERS, BUT GROWTH MATTERS MORE

Macro Drivers: Despite the soft payroll numbers, a US recession remains unlikely ◼ Multi Asset: Fed cuts are only good for risk assets when a recession does not follow

海外研报

2024年08月12日

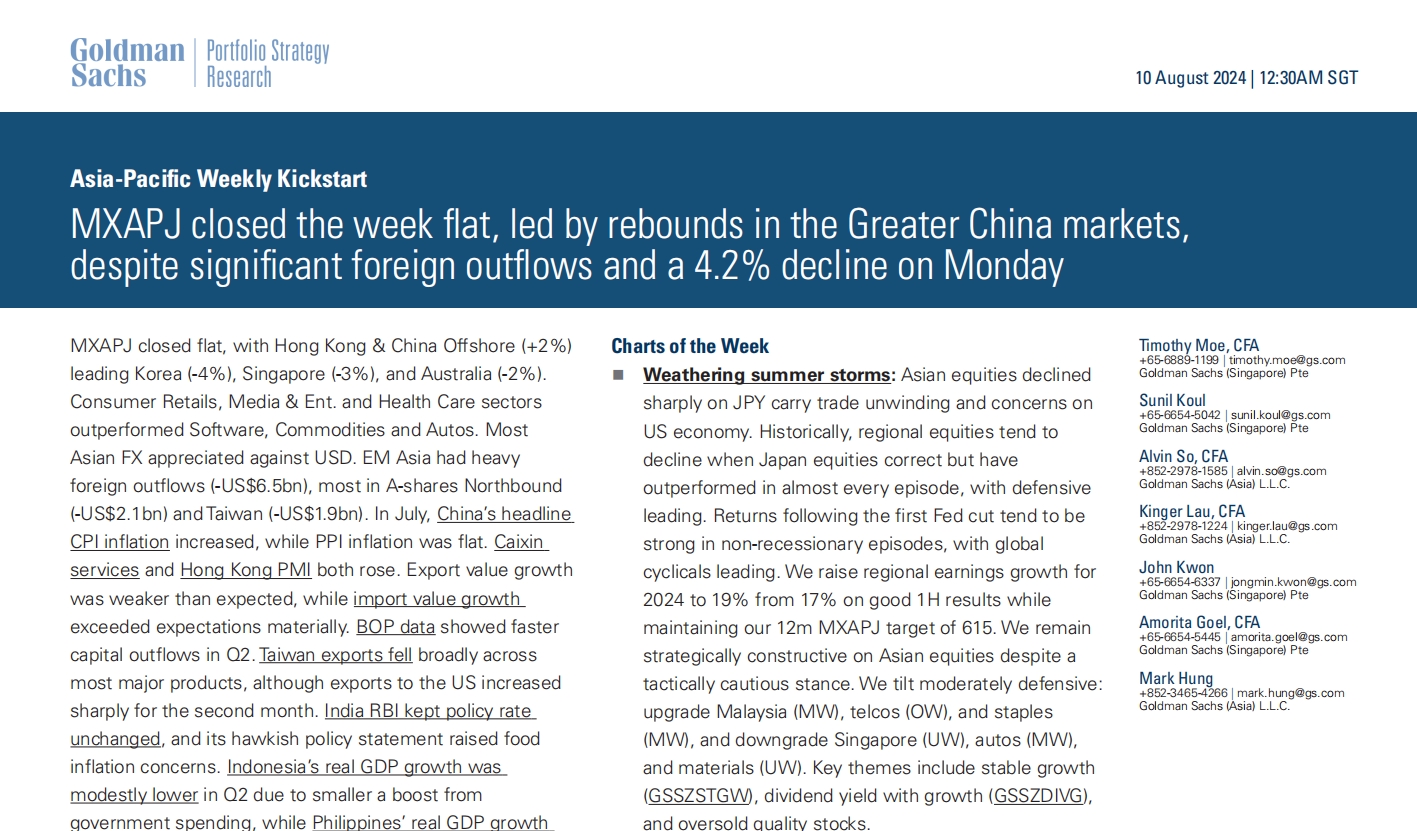

MXAPJ closed the week flat, led by rebounds in the Greater China markets

MXAPJ closed flat, with Hong Kong & China Offshore (+2%)leading Korea (-4%), Singapore (-3%), and Australia (-2%).

海外研报

2024年08月12日

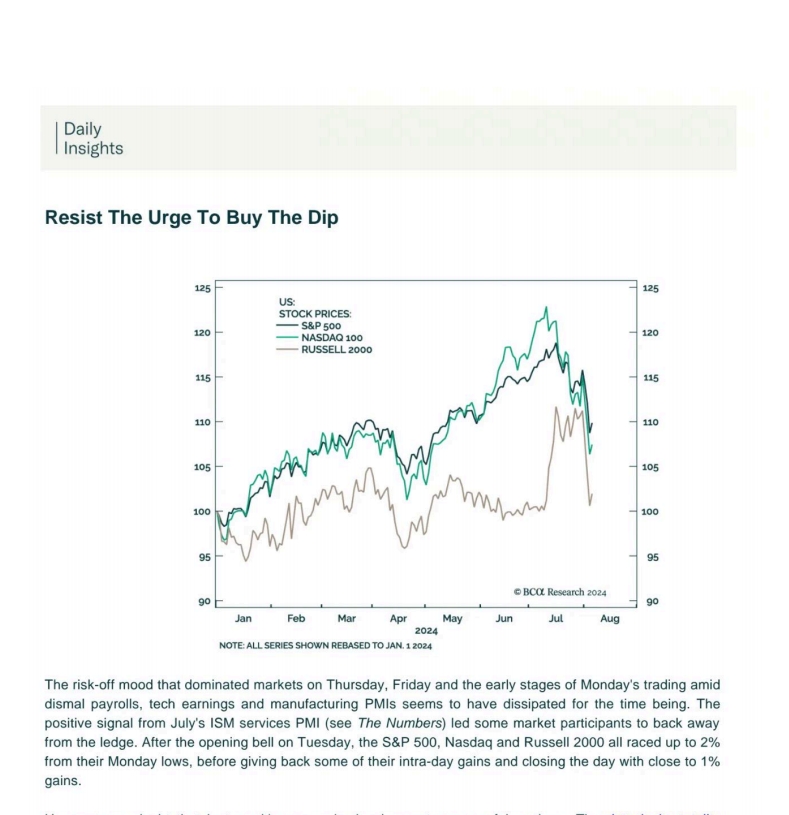

Resist The Urge To Buy The Dip

The risk-off mood that dominated markets on Thursday, Friday and the early stages of Monday's trading amiddismal payrolls, tech earnings and manufacturing PMls seems to have dissipated for the time being. Thepositive signal from July's iSM services

海外研报

2024年08月12日

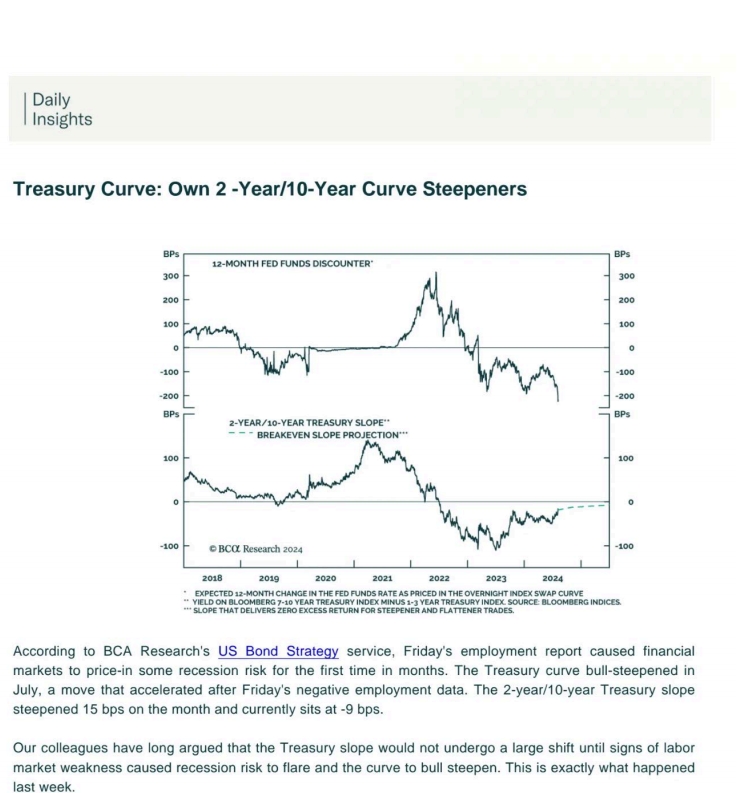

Treasury Curve: Own 2 -Year/10-Year Curve Steepeners

According to BCA Research's US Bond Strategy service, Friday's employment report caused financiamarkets to price-in some .

海外研报

2024年08月12日

European equities: Q2 2024 earnings season recap

Cautious guidance: Current market volatility is due to a combination of factors in a poorliquidity month and cautious corporate guidance. We continue to recommend a defensivestance and buying into high-quality companies that have derated.

海外研报

2024年08月12日