海外研报

筛选

Global Equity Market Arithmetic

Equities bounced back strongly last week, with the MSCI World gaining 4.0% to leave it just 1% away from its all-time high. The S&P 500 has now recouped the losses that started initially on 11

海外研报

2024年08月21日

US Election Cheatsheet_ All facts, no fiction

We address 12 frequently asked US election questions - whether you just want to brush up on basics or understand

海外研报

2024年09月22日

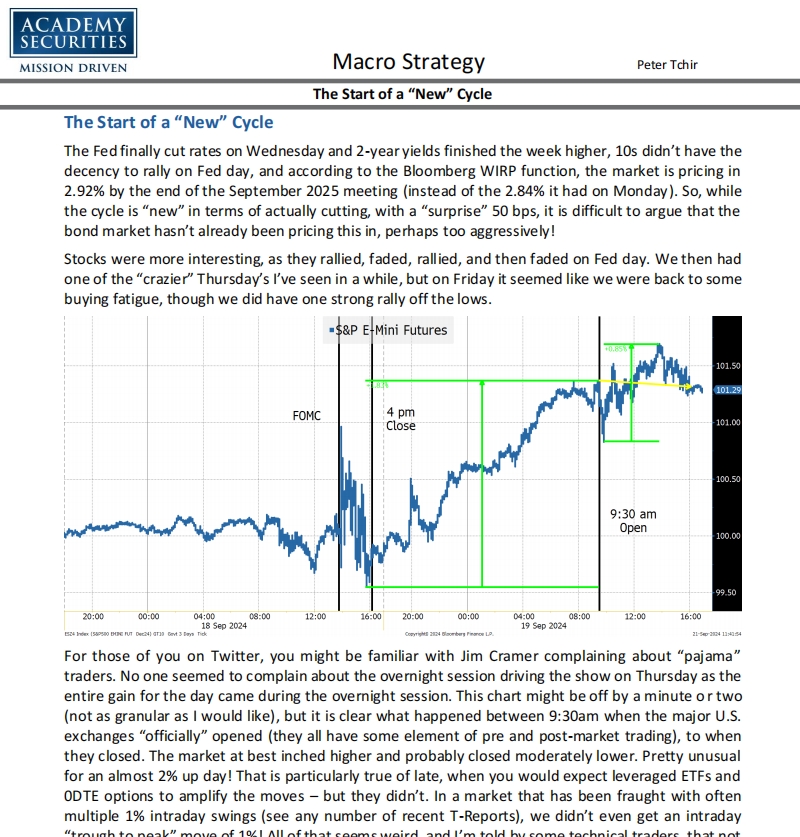

The Start of a New Cycle

The Fed finally cut rates on Wednesday and 2-year yields finished the week higher, 10s didn’t have the decency to rally on Fed day, and according to the Bloomberg WIRP function, the market is pricing in

海外研报

2024年09月23日

UBS--China’s policy pivot gathering momentum

meeting to focus entirely on economics, just two days

海外研报

2024年09月29日

Barclays_China stimulus Incremental vs bazooka_20240927

September's Politburo meeting reinforced expectations that

海外研报

2024年10月01日

DB - China Macro - How is this time different_20240930

Whie saly market reactions have been posiive, sustained momentwn hinges onswift irnplentatio of

海外研报

2024年10月02日