海外研报

筛选

Citi_Commodities Flows Dovish FED and the 4Q 2024 Commodities Market Outlook_20240923

Citi published its flagship Global Commodities Quarterly on Sunday 15thSeptember, in advance of a dovish September FOMC. The Fed delivered a 50

海外研报

2024年09月25日

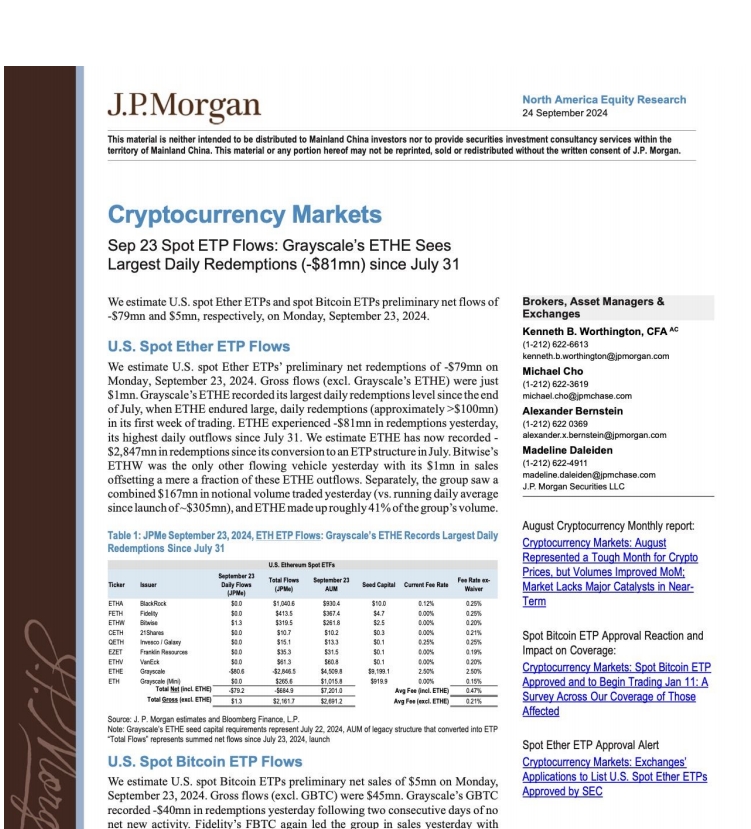

Citi_Digital Asset Bi-Weekly Will Fed easing support crypto and reverse ETH ETF outflows_20240923

Outflows from ETH ETFs since their July launches have totaled $610mm,

海外研报

2024年09月25日

Citi_Global FX Strategy Today’s data reinforce our bearish EURUSD view_20240923

CITI’S TAKE

海外研报

2024年09月25日

EM EMEA Weekly

Macro focus: Fed easing should relax the constraints on EM policymakers and support a widening out of the EM rate easing cycle – with our eyes on India, South

海外研报

2024年09月25日

GS--Global Economics Comment: What Prompts DM Pivots to Sequential Cuts? (Briggs/Peters)

Several central banks—including the BoC, RBNZ, Riksbank, and the Fed—have n

海外研报

2024年09月25日

GS--Global Markets Daily: The UST Buyer Mix around the First Cut (Pereira)

nmoney funds. Levered demand (proxied by the “households” flow of funds

海外研报

2024年09月25日

GS--Discussing key debates and updating our trackers ahead of F1Q results

Ahead of NKE’s F1Q result scheduled for October 1st, we discuss

海外研报

2024年09月25日

September_RBA_Board_meeting_and_SMP

The RBA Board left the cash rate unchanged (as was widely expected) and retained a hawkish tone to the post-meeting statement, with data since the

海外研报

2024年09月25日

The Final Phase of the Disinflation Process With Positive Ef

Is high inflation good for a currency, or low inflation? Those who trade currencies day

海外研报

2024年09月25日