海外研报

筛选

GS--Global FX Trader Is The First Cut the Deepest?

USD: Fed brings better balance; adjusting our forecasts. With a 50bp rate ncut, the FOMC most likely chose the option that leads to lower economic and1

海外研报

2024年09月23日

GS--Healthcare Pulse: Macro/Micro Mash-Up ... Investor sentiment

The T+1 reaction function across HC in the immediateaftermath of this week’s Fed cut was consistent with “right

海外研报

2024年09月23日

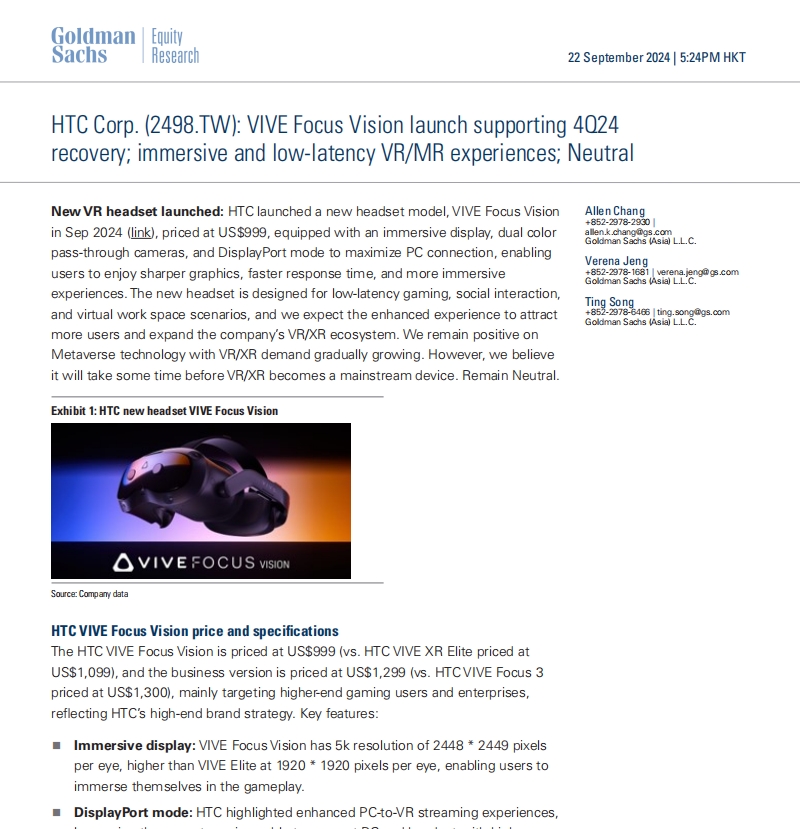

GS--VIVE Focus Vision launch supporting 4Q24 recovery; immersive and low-latency VR/MR experiences

New VR headset launched: HTC launched a new headset model, VIVE Focus Visionin Sep 2024 (link), priced at US$999, equipped with an immersive display, dual color

海外研报

2024年09月23日

JPM_Positioning Intell Weekly Wrap_20240920

In the US, HFs remained net sellers (-1.3z in past 5d) as selling/de-grossing prior to the Fed was not reversed on Wed/Thurs. Gross and net leverage were basically unchanged WoW. Retail investors did not seem particularly

海外研报

2024年09月23日

UniCredit Carbon Weekly - Long and short of it_20240917

Further EUA downside looks limited for the coming weeks as CTAs have remained netshort and are unlikely to sell more, having largely maximised their positions.

海外研报

2024年09月23日

UniCredit_BOE REVIEW_20240919

MPC sees gradual cuts, but we think they will move fasterThe Bank of England’s Monetary Policy Committee (MPC) voted 8-1 to leave the bank rate unchanged at 5.00% today. It voted

海外研报

2024年09月23日

UniCredit_Sunday Wrap_20240922

Two additional road signs emerged this past week, confirming the direction of travel for economic policies in the Western world.

海外研报

2024年09月23日

UniCredit_WEEKLY SUPPLY PREVIEW EGB supply to remain at around EUR 25bn_20240916

EGB supply to remain at around EUR 25bn• Last week: EGB supply from Italy, Germany, the Netherlands and Ireland

海外研报

2024年09月23日