海外研报

筛选

Remain LT bullish on Private Credit & less concerned with credit within our coverage

Remain bullish on private credit – long and short-termAs we prepare for lower interest rates, we have monitored an increase in investor inbound

海外研报

2024年09月22日

precision-insights-credit-sep-24

With most developed market (DM) central banks having kicked off their rate cutting cycles, high yield

海外研报

2024年09月22日

precision-insights-em-august-2024

We outline our latest views on emerging market (EM) single countries, updated regularly to reflect the latest macro and .

海外研报

2024年09月22日

Quick RIC - Between a stock and a hard place

The teetering tactical case for stocksUntil the data improve or the Fed panics, we are tactically more cautious. Move up in

海外研报

2024年09月22日

GS--Takeaways from Digital Forum: Underappreciated Technology Value

We attended the SLB Digital Forum in Monaco, which broughttogether 1,400 customers and technology partners, and highlighted

海外研报

2024年09月22日

Taboo--Global Daily Market comments

This week we learned how (not) to say you believe you may be behind the curve without saying you are behind the curve, like a bad game of Taboo. Markets continued to celebrate the outsized

海外研报

2024年09月22日

GS--The consumer, savings and stock performance

UK households benefit from positive real incomegrowth; the latest labour market data show private sector

海外研报

2024年09月22日

GS--What’s Next in Gas: Potential Ukraine transit deal poses downside risk to our TTF forecast

News today (September 19th) of a potential deal between Ukraine andAzerbaijan that would effectively prevent the halt of the remaining 42 mcm/d of

海外研报

2024年09月22日

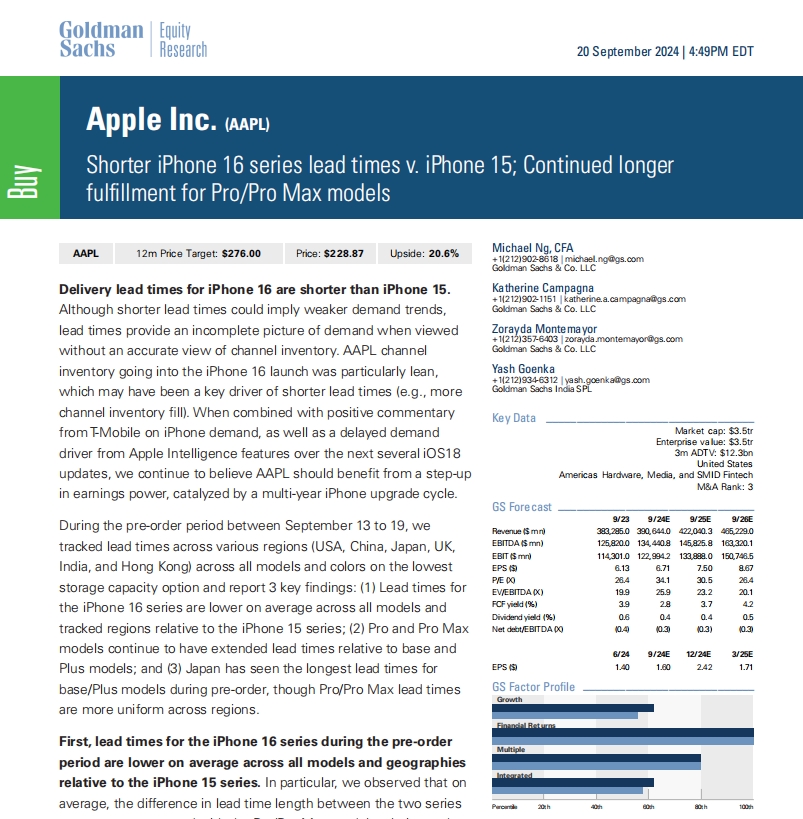

GS--Shorter iPhone 16 series lead times v. iPhone 15; Continued longer fulfillment for

Delivery lead times for iPhone 16 are shorter than iPhone 15.Although shorter lead times could imply weaker demand trends,

海外研报

2024年09月23日

GS--How Global Economic News Affects AEJ Financial Markets

The release of information about activity, inflation, or other aspects of an economycan have a substantial impact on financial markets. In this piece, we crunch through

海外研报

2024年09月23日