海外研报

筛选

GS--Norway: Norges Bank Preview — A Hold Now But Dovish Tilt Coming

BOTTOM LINE: August inflation in Norway was notably below Norges Bank’sexpectations, with core services inflation falling to its lowest value since August

海外研报

2024年09月16日

SocGen - Fixed Income Weekly - Easing into it

The ECB delivered a second 25bp cut in the DFR and confirmed its data-dependent approach for upcoming meetings. Inflation is projected to return to target in late 2025,

海外研报

2024年09月16日

SocGen - Market Wrap-up - Is it time to rethink our credit view.

The markets had a positive start to the session ahead of the US CPI numbers, with equity indices gaining around half a percentage point and sovereign bond yields falling by a

海外研报

2024年09月16日

SocGen - Multi Asset Portfolio - Cracks in US exceptionalism

Societe Generale (“SG”) does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that SG may

海外研报

2024年09月16日

SocGen - On Our Minds - BoE preview – on hold and a further £100bn QT envelope

August’s narrow vote in favour of a cut, with some members who voted for the cut describing the decision as “finely balanced”, implies that the MPC will proceed

海外研报

2024年09月16日

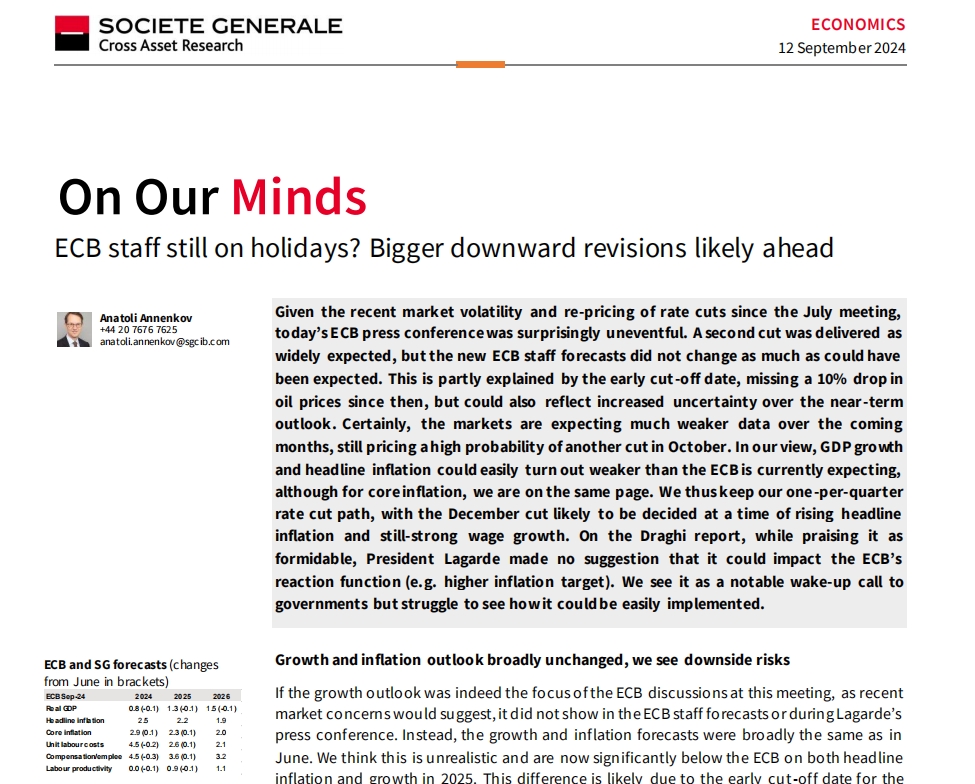

SocGen - On Our Minds - ECB staff still on holidays. Bigger downward revisions likely ahead

Given the recent market volatility and re-pricing of rate cuts since the July meeting, today’s ECB press conference was surprisingly uneventful. A second cut was delivered as

海外研报

2024年09月16日

SocGen - On Our Minds - LDP presidential election and future economic policy

The LDP presidential election is to be held on 27 September. A record nine people have announced their candidacy. As Diet members’ votes are expected to be dispersed among

海外研报

2024年09月16日

UBS_WA (30)

In this note we preview the coming week's corporate events Below we highlight three key events for next week. Please see this excel for a full list of

海外研报

2024年09月16日

USA_ Core Import Prices Decrease Below Expectations

BOTTOM LINE: Import prices and import prices ex-petroleum decreased in August,below consensus expectations. Following this morning’s import price data, we

海外研报

2024年09月16日

GS--USA: UMichigan Sentiment Above Expectations

BOTTOM LINE: The University of Michigan’s index of consumer sentimentincreased in the September preliminary report, slightly above consensus

海外研报

2024年09月16日