海外研报

筛选

PositioningInteligence-Monthly chartbook

This material (“Material”) is not a product of J.P. Morgan’s Research Departments and should not be viewed as a research report. The Material is provided by J.P. Morgan’s Prime Finance business for informational purposes

海外研报

2024年09月06日

THE CHINA+ ECONOMIC MONITOR

The Caixin manufacturing index continues to outperform the official gauge, but both are at low

海外研报

2024年09月06日

Potentially Negative Effects of AI on Oil Production Costs and Oil Prices

Energy firms now mention AI more frequently on earnings calls and use AI more nthan the median firm in the economy. The debate on the impact of AI on energy

海外研报

2024年09月06日

Credit CallsTuesday, September 03, 2024

Strategy & Sector CommentaryAsia Cross Regional Credit Weekly: Jobs reportand newissue supplyin foeus(Yoshie Fujimoto /Nathaniel Rosenbaum, CFA/Eric Beinstein /Soo Chong Lim)The US HG market tightened last week with the JULIportfolio s.

海外研报

2024年09月06日

Telecom KPIs: Mobile ARPU bottoming out, but competition for subscribers intensifying

Mobile service revenue at the three major MNOs (NTT DoCoMo, KDDI, and nSoftbank) in April-June 2024 totaled ¥1,383.9 bn (-0.4% yoy/-¥4.9 bn yoy).

海外研报

2024年09月06日

HFs Sellers of N. Am Equities Despite Market Breadth Improving

Volumes remained lower ahead of the holiday weekend, however the market posted notable signs of improving breadth as the equal

海外研报

2024年09月06日

GS Healthcare: Back-to-School Kickstart

Performance, Valuations, Revisions. On the year, HC is still middle-of-the-pack n(+15% vs SPX +19%) albeit with improved performance in the first two months

海外研报

2024年09月06日

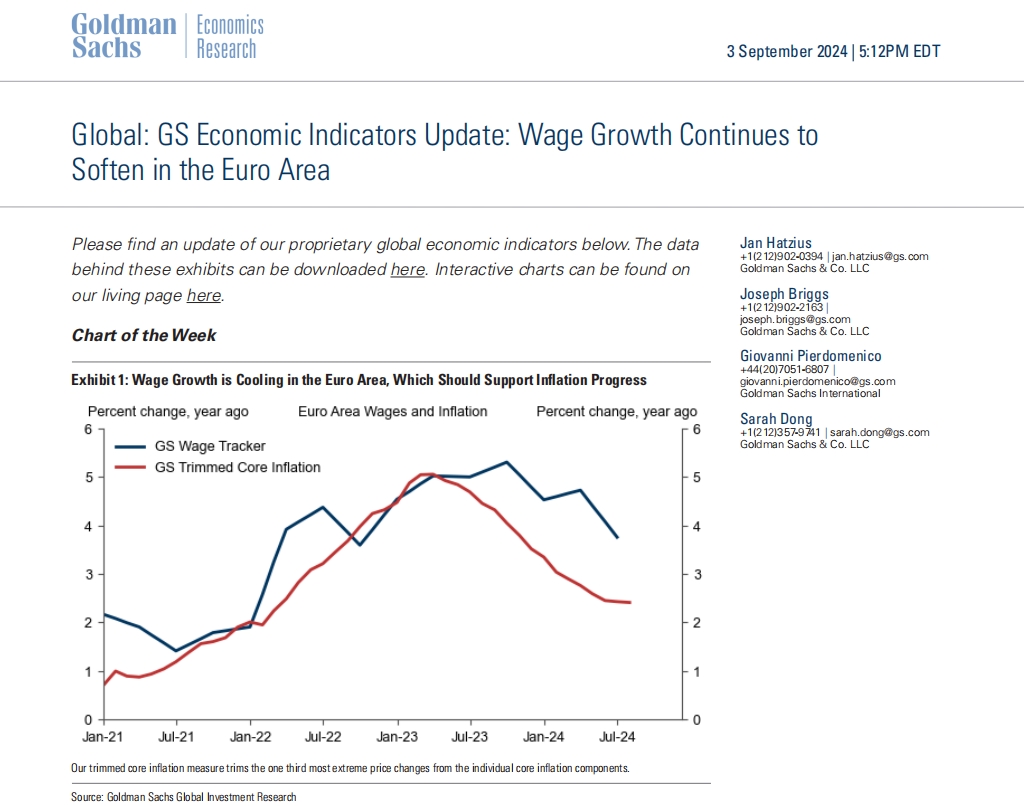

Global: GS Economic Indicators Update: Wage Growth Continues to Soften in the Euro Area

Please find an update of our proprietary global economic indicators below. The data

海外研报

2024年09月06日

CitiFX Wire | Technicals

NOT A PRODUCT OF CITI RESEARCH – THIS IS MARKET COMMENTARY INTENDED FOR INSTITUTIONALCLIENTS ONLY. CLIENTS SUBJECT TO MIFID SHOULD NOT READ THE INFORMATION BELOW UNLESS

海外研报

2024年09月06日

The Point for Asia Pacific Tuesday, 03 September 2024

We recently asked investors what their expectations were for GMG underlying EPS growth. The results were mixed with 26% of respondents expecting results in line

海外研报

2024年09月06日