海外研报

筛选

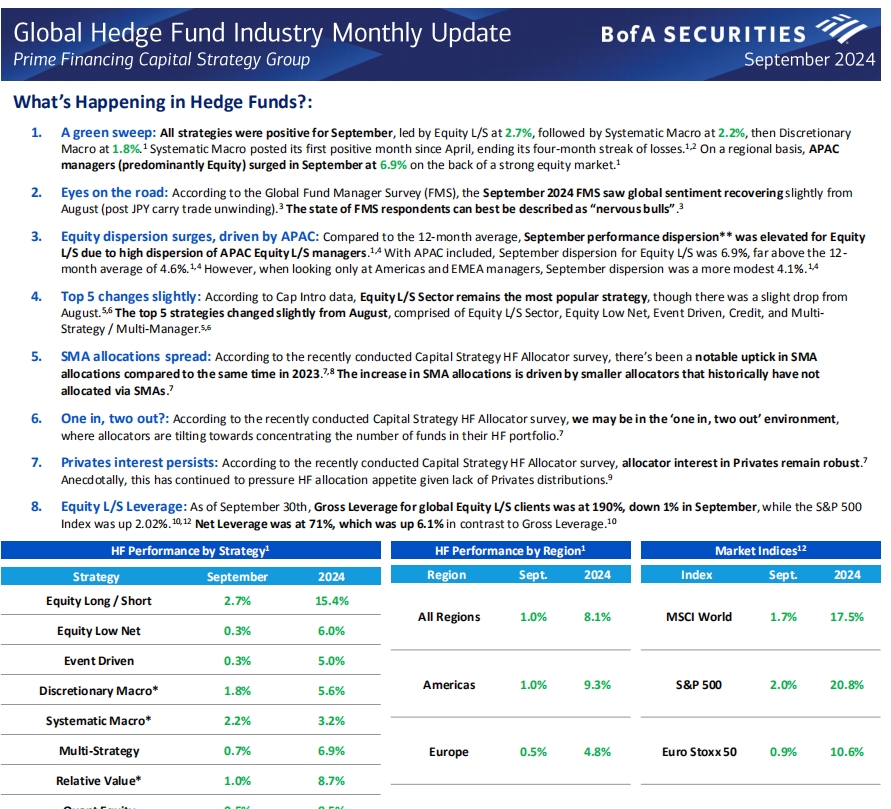

BofA Monthly HF Update September 2024

A green sweep: All strategies were positive for September, led by Equity L/S at 2.7%, followed

海外研报

2024年10月19日

From the Global Director of Research | North America

A guiding principle at Morgan Stanley Research is to enhance your investment process by delivering unique insights that

海外研报

2024年07月31日

Robust headline growth with underlying weakness

Indonesia’s 2Q24 real GDP growth printed at 5.05% yoy, a tad higher than our expectation of 5.04% and lower than the 5.1% recorded for 1Q24. While a weak deflator

海外研报

2024年08月08日

Navigating 2025 AI cloud investment

The Morgan Stanley tech team's median expectation is for NVIDIA-related stocks to grow 37% Y/Y and non-NVIDIA to grow 14%.

海外研报

2024年08月12日

StoneX Strategy U.S. Landing Gear Engaged, Labor Data in Focus

StoneX Strategy U.S. Landing Gear Engaged, Labor Data in FocusA spate of recent data indicate that while the U.s. labor market has slowed, the economy has avoidedspiraling into recession

海外研报

2024年08月30日

GS--Communacopia + Technology Conference 2024 — Key Takeaways02

Bottom line: We have three key takeaways: (1) IBM sees solid underlying demandin infrastructure Software despite weaker discretionary spending (which is a

海外研报

2024年09月16日

IFAST Corporation Ltd

TTuurrnniinngg mmoorree ppoossiittiivvee aass kkeeyy ggrroowwtthh ddrriivveerr,, tthhee eePPeennssiioonn bbuussiinneessss,, rreeppoorrttss ssttrroonngg pprrooggrreessss.. The

海外研报

2024年07月27日

Disinflation set to continue, but upside risks are plentiful over the summer

The disinflation in both headline and core inflation has stalled. Negative base effects will likely drag headline inflation to within touching distance of 2% in the autumn, but it will

海外研报

2024年07月31日

Macro2Market Views Post the MacroMania

The super-macro week of late July/early August led to a volatile adjustment in pricing and positioning. As the dust settles, we remain vigilant and unconvinced that the coast is clear.

海外研报

2024年08月08日

Tomorrow, back to only thinking "Rate cuts!"

Today, markets are only interested in one economy, one field, and earnings from one company,which may or may not be in a bubble. It makes a change from a focus on “Rate cuts!” I guess. But

海外研报

2024年08月30日