海外研报

筛选

MARKETS CAN TAKE WEEKS TO REBOUND FROM A VOLATILITY SPIKE

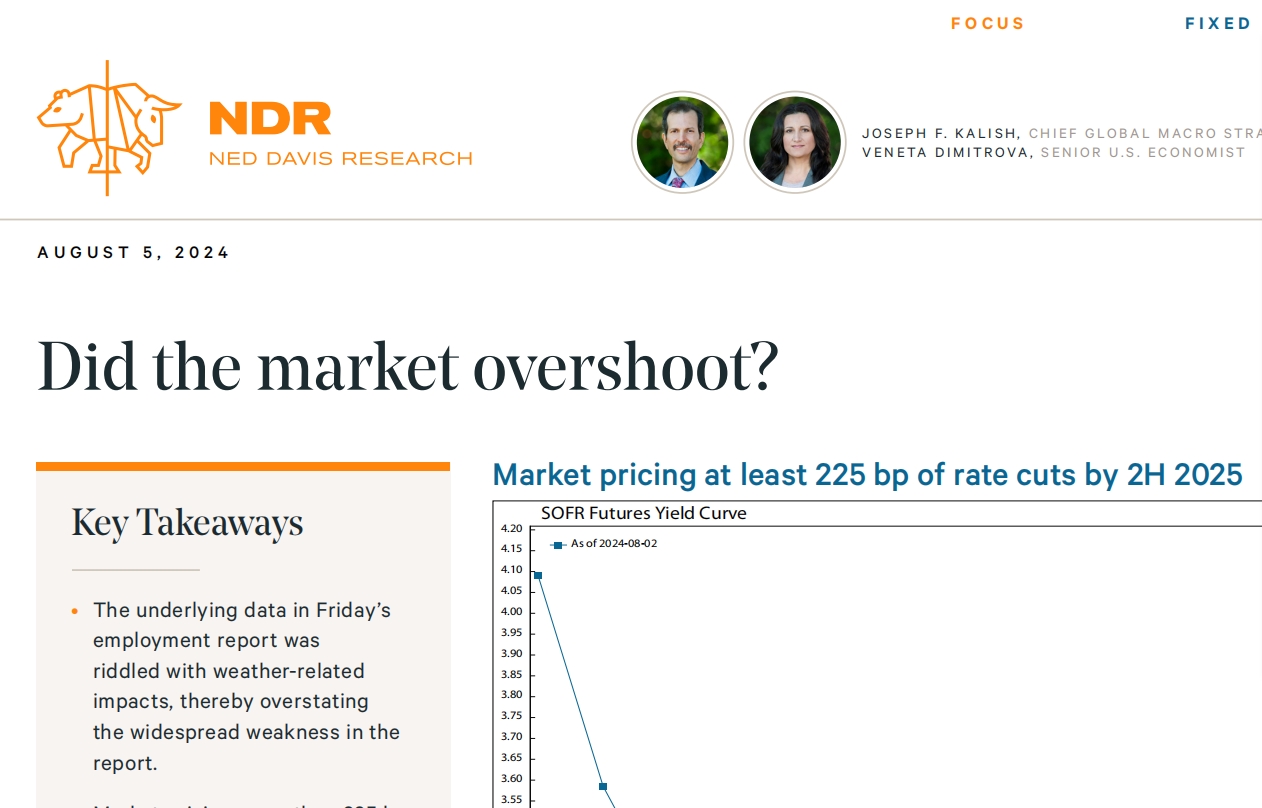

Friday’s weak NFP print put recession risks front and centre. However, one disappointing payrolls release is notenough to declare one: (1) 114k new jobs are consistent with economic expansion; (2) cyclical sectors are still

海外研报

2024年08月06日

GS Utilities Daily: ENWL sale has positive read across to SSE

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

海外研报

2024年08月06日

US July jobs report: Broad-based weakening risks steeper cuts

• A sizable deceleration in payrolls and the fourth consecutive increase in the unemployment rate (which triggered the Sahm Rule) point

海外研报

2024年08月06日

Market Intelligence: US Morning Update

Stocks in Asia traded sharply lower Monday as concerns about a soft landing in theUS after weaker than expected US payrolls from Friday (see Aug 2 note “USA:

海外研报

2024年08月06日

US MARKET INTELLIGENCE:AFTERNOON BRIEFING

US: Stocks closed sharply lower but off their lowest levels. Pre-market, the global selloff startedwith Japan as the NKY fell by 12.4%. The SPX hit a session low of -4.6%, with the ViX spiking to65, up 178% from Friday's close of 23. This was driven by a

海外研报

2024年08月06日

Healthcare Pulse: Oh August... Investor sentiment

Considerations for the XLV @ 10k Feet. Macronarratives got turned on their head yet again with the

海外研报

2024年08月06日

Obvious trend damage but breadth improves

• Background macro factors like disposable personal income growth

海外研报

2024年08月06日