海外研报

筛选

The Major bond letter Free to View Fixed Income - Rates Global #52. Turning points

Head fake or the real thing? The question bond investors and traders are debating today is whether the events of the last few weeks will mark a decisive turning point

海外研报

2024年08月20日

What Companies Are Saying: StillWaiting And Seeing

Companies broadly report steady growth butnota lotofupward momentum as theyand their customers are still in a pervasive wait and see loop given lingeringuncertainties around inflation, interest rates, domestic politics, elections,

海外研报

2024年08月20日

The yen carry trade-what if Japaninstitutions decide to unwind?

Public pension funds. lhe GPlF is the big one here, with other smallerfunds believed to generally follow its lead. There's a growing view that theGPIFcould cutforeign bond exposure when it announces its next policy mixin 2025.

海外研报

2024年08月20日

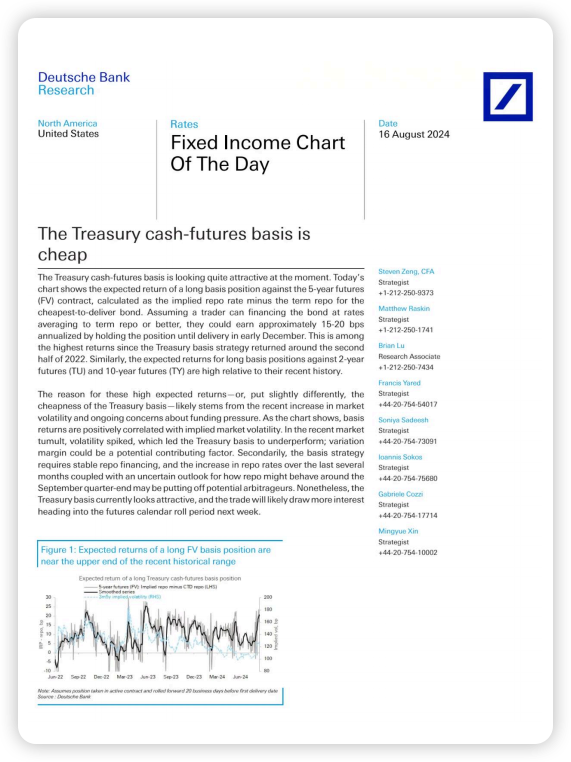

The Treasury cash-futures basis ischeap

The reason for these high expected returns-or, put slightly differently, thecheapness of the Treasury basis -likely stems from the recent increase in marketvolatility and ongoing concerns about funding pressure. As the chart shows,

海外研报

2024年08月20日

Market expectations of the Fed's labormarket reaction

Today's chart explores how these changes as well as other dynamics over recentyears may have affected market expectations of the FOMC's reaction to the labormarket, drawing onaspecialquestiontheNYFed periodicallyincludesin

海外研报

2024年08月20日

Confidence Game-Global Daily

As we approach the Jackson Hole Symposium later this week the message from Fed speakers, broadly, has been that they are gaining confidence that the economy is reaching the point where

海外研报

2024年08月20日