海外研报

筛选

Investment Banking Monitor: Some improvement in M&A and DCM, but weaker ECM

Announced August investment banking activity levelsrose 9% YoY and were only 2% below average August

海外研报

2024年09月05日

TOP 5 CLIENT QUESTIONS

Is the US in recession or will it be in the next 12 months? Recession probably hasn’t started yet. The economy is entering a soft patch but the Fed will now begin cutting every

海外研报

2024年09月05日

Weekly commentary

Patience needed in the AI buildout• Investors have started to worry about tech companies spending big on artificial

海外研报

2024年09月05日

September Analyst Day Opportunities

Our research shows that call buying around analyst days has been asystematically profitable option buying strategy over the past 20 years. Buying

海外研报

2024年09月05日

Potential implications of corporate tax reform for S&P 500 earnings

Recent investor questions have focused on the possibility of changes tocorporate tax policy following the upcoming US elections in November. While

海外研报

2024年09月05日

The Harris Bounce US special

Summary With Kamala Harris on top of the Democratic ticket, the odds for the Democrats have dramatically improved. After weeks of media hype and her nomination at the Democratic

海外研报

2024年09月05日

The EM Trader When the Fed Cuts

EM fixed income outperforms through August volatility. EM fixed income n(and EM local rates in particular) has been able to outperform through a volatile

海外研报

2024年09月05日

Outlook for 2H 2024

The AI boom is driving massive investments in GPU clusters, reshaping techinfrastructure and boosting demand for power systems. Meanwhile, software

海外研报

2024年09月05日

Overheating Brazilian economy; dovish Chilean central bank

Brazil: strong 2Q24 growth (1.4% qoq vs consensus and our estimate of 0.9%) was led by strong domestic demand fueled by fiscal expansion. The economy is

海外研报

2024年09月05日

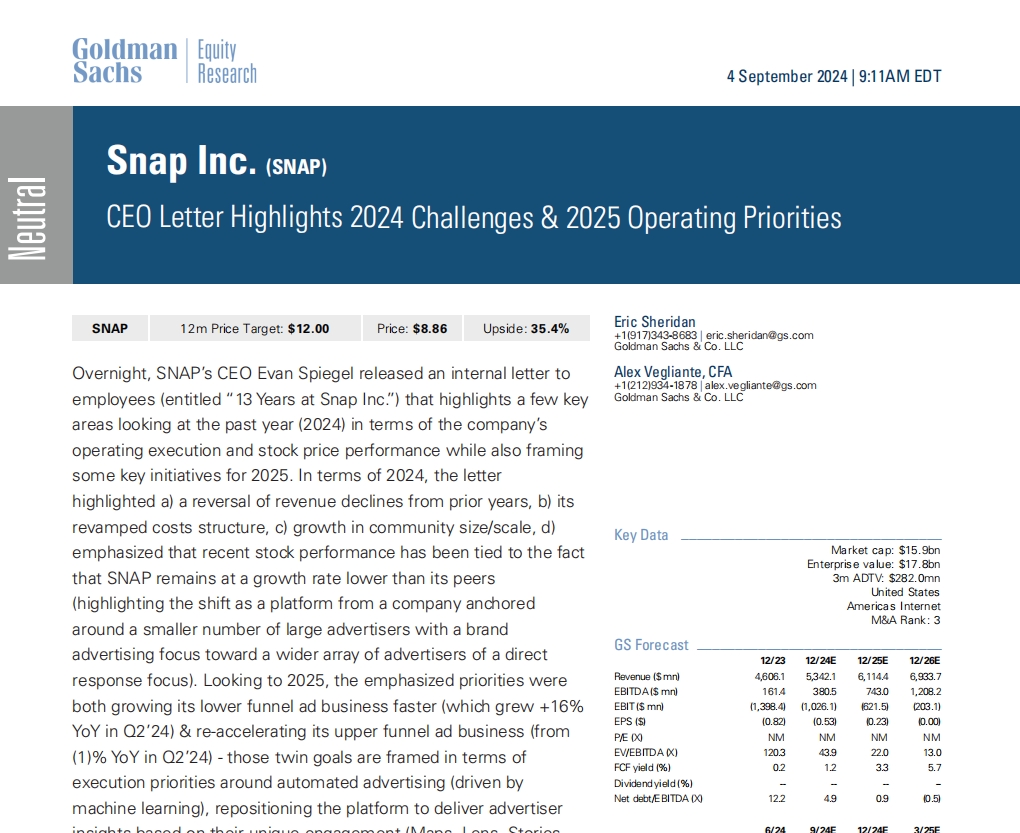

CEO Letter Highlights 2024 Challenges & 2025 Operating Priorities

Overnight, SNAP’s CEO Evan Spiegel released an internal letter toemployees (entitled “13 Years at Snap Inc.”) that highlights a few key

海外研报

2024年09月05日